Also this is slightly off topic others who have filed their 2014 returns wish now to use the safe harbor for small taxpayers or the de minimis safe harbor.

Minimis safe harbor roof replacement.

Replacing 30 or more of a building component for example roof windows floors electrical system hvac etc.

It does not matter if the item would be considered a repair or an improvement as long as the item costs less than 2 500.

Similarly the de minimis safe harbor doesn t change your ability to deduct repair and maintenance costs that don t qualify under the de minimis safe harbor for example costs that exceed the safe harbor.

If you qualify to use it you may currently deduct on schedule e all your annual expenses for repairs maintenance improvements and other costs for business real property including rental property owned by landlords.

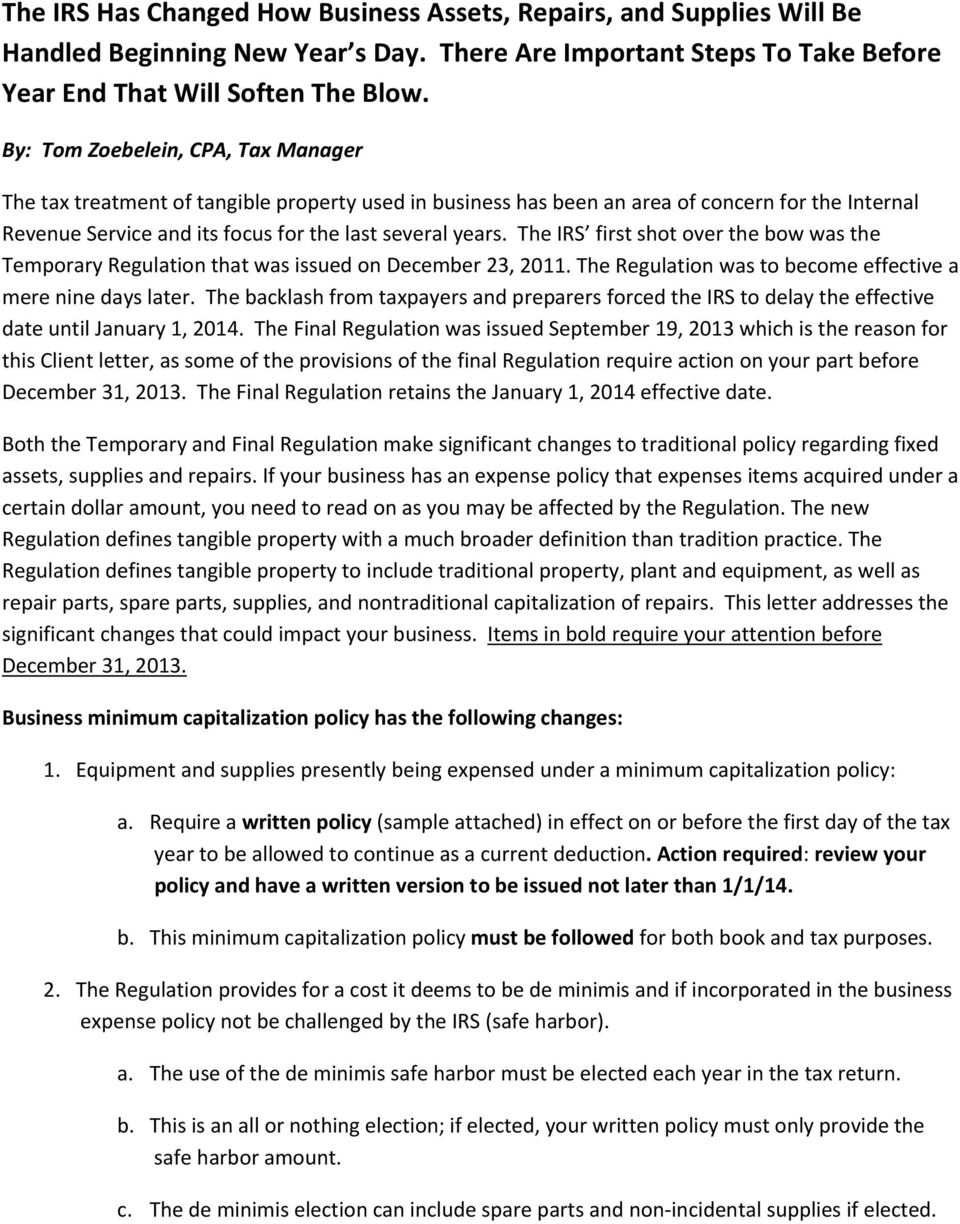

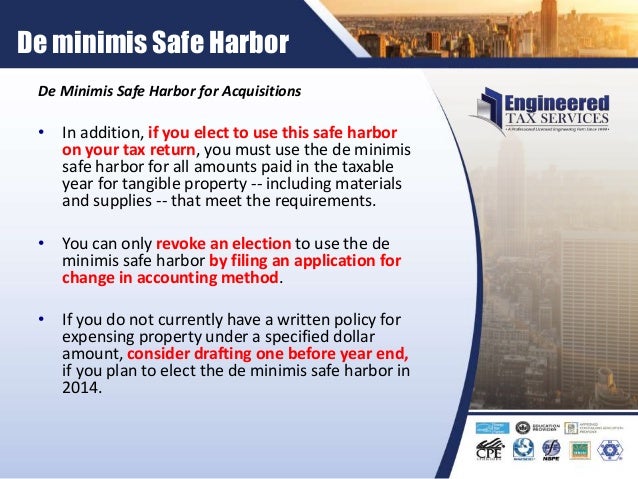

First you re going to want to see if you can avail yourself of three safe harbors that exist under the final regulations.

Their forms were completed very early in late 2014.

You do have an option of using the safe harbor election if you qualify.

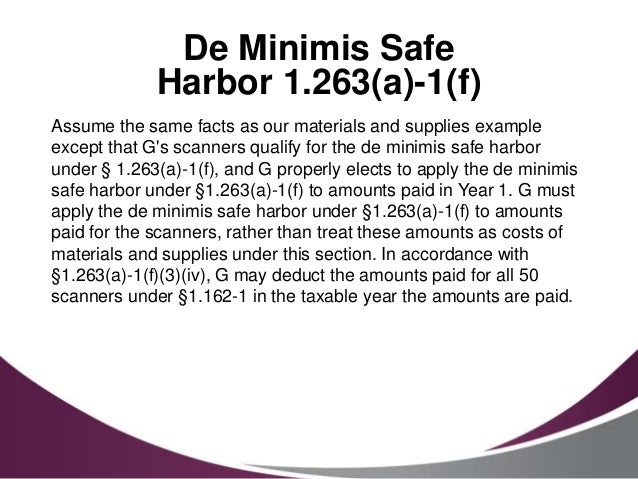

De minimis safe harbor.

All of this is so confusing.

The safe harbor for small taxpayers shst.

Or have they lost that option.

The 5 000 500 de minimis safe harbor the small building safe harbor.

However the de minimis safe harbor doesn t change your ability to deduct costs for materials and supplies incidental or non incidental that don t qualify under the de minimis safe harbor.

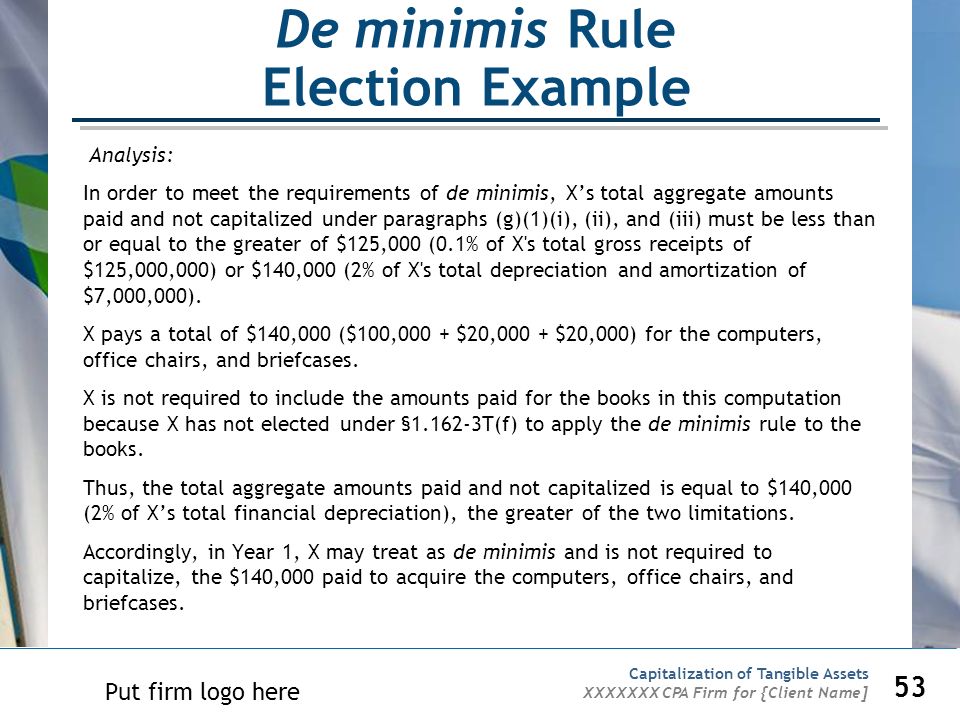

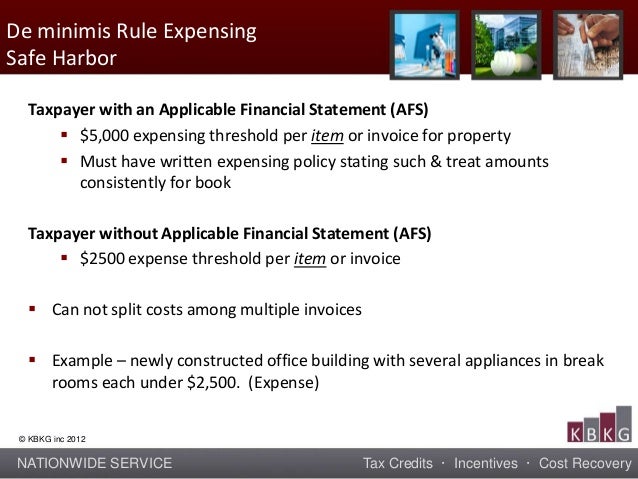

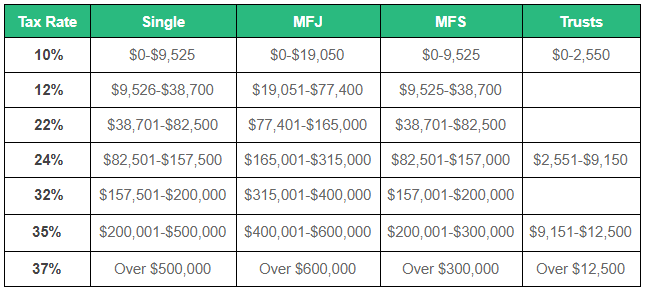

The amounts allowable under the de minimis safe harbor are 2 500 or 5 000 depending on whether the taxpayer has an applicable financial statement afs.

Taxpayers with an afs may use this safe harbor to deduct amounts paid for purchases and or improvements of tangible property for up to 5 000 per invoice or item provided that this accounting procedure is in writing.

Landlords can use this safe harbor to deduct low cost personal property items used in their business.

This is up from 500 which was the threshold through december 31 2015.

A business with an applicable financial statement however has a safe harbor amount of 5 000.

This expense is a capital improvement which makes the decision and the calculation a bit more complicated.

The de minimis safe harbor is the last safe harbor outlined by the final irs regulations.

We walk through common examples of what rental property work you should classify as repair and maintenance or capital improvement.

1 263 a 3h took effect at the start of 2014.

Using the deduction under the de minimis safe harbor election is definitely the best option.